In a market where brokers often overpromise and underdeliver, the question posed by the title — Gracex Reviews: What Makes This Broker Stand Out in 2025 — demands a factual, grounded answer. Gracex positions itself as a modern broker, cutting away legacy inefficiencies with zero spreads, no commissions, and pure STP execution. But does it live up to the claims? Let’s break it down by execution quality, trading costs, platform performance, user feedback, and overall usability to see what holds true — and what’s just good marketing.

Low-Cost Execution: The Heart of Gracex’s Appeal

Gracex’s core offering revolves around zero spreads from 0.00 pips, 0% trade commissions, and no swaps. This combination drastically reduces the total cost of trading. Add pure STP execution with no dealing desk, and traders receive direct market access with minimal latency and no broker-side conflict of interest.

On popular pairs like EUR/USD, traders frequently report spreads of 0.0–0.2 pips without hidden costs. Compared to standard brokers charging 1–1.5 pips plus $7 commissions per lot, this model can save active traders thousands over time.

This is a direct answer to the title’s claim: Gracex really does stand out in 2025 for low trading costs.

Trading Platform: Full Access to MetaTrader 5

Gracex supports MetaTrader 5 across web, desktop, Android, and iOS. The platform comes fully unlocked for expert advisors (EAs), indicators, and advanced charting. With server pings under 30ms for most clients, execution is consistently stable, even during high-volatility events.

Unlike many brokers, Gracex provides complete functionality across all account types — even FREE and CENT users can deploy bots and custom scripts without restriction.

That makes it clear: Gracex offers a full MT5 experience in 2025, and users confirm this in reviews.

Who Is Gracex? Vision and Licensing

Gracex describes itself as a tech-driven broker built to eliminate the inefficiencies of outdated brokerage models. It is registered under license L15817/GL from the Union of Comoros (Anjouan), follows KYC/AML regulations, and maintains segregated client funds.

While the regulation isn’t top-tier (e.g., CySEC or FCA), it provides basic consumer protection and is widely used among STP brokers.

In short, Gracex’s model is built around clarity, efficiency, and ease-of-use — and it shows.

Account Types Explained by Trader Profile

- FREE: For beginners; up to $500 balance, no commissions or monthly fees.

- ZERO: For active traders; $100 monthly fee, spreads from 0.00 pips, zero commissions.

- FIX: For conservative strategies; fixed spreads from 3 points, no surprises during volatility.

- CENT: For micro-scale beginners; $10 per lot, ideal for training with real money at low risk.

All account types support the same MT5 tools and access to Gracex’s additional services like copy trading and bonuses.

Gracex clearly segments its accounts by use case, not marketing gimmicks — a strength highlighted in 2025 reviews.

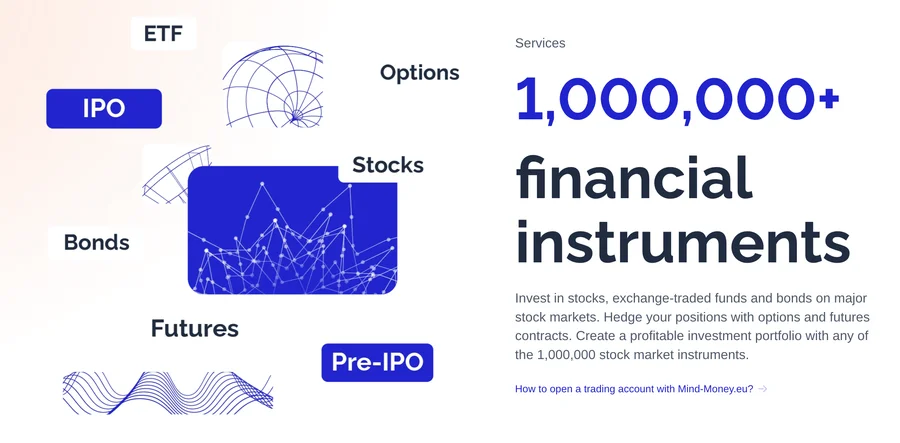

Markets Offered: More Than Just Forex

Traders on Gracex can access:

- Forex — majors, minors, exotics

- Indices — global and regional

- Metals — gold, silver, platinum

- Energy — oil, gas

- Crypto assets

- Regional CFDs — by continent or sector

Asset classes are supported by the same fee-free model and STP routing. Whether you’re trading gold or South American tech stocks, execution remains transparent.

Gracex reviews in 2025 show praise for broad market access and reliable liquidity.

Support Tools: Copy, PAMM, Bonuses, and Education

Gracex integrates several tools to support traders at all levels:

- Copy Trading — follow verified strategies automatically

- PAMM Accounts — allocate funds to professional managers

- Bonuses — available for first deposits and referrals

- Education — includes webinars, video tutorials, and strategy guides

All features are accessible from the FREE account onward. This removes the usual paywalls and promotes learning-by-doing.

Gracex builds real accessibility into its offer — and user feedback supports this.

Customer Support and Awards

In 2024, Gracex received two industry awards:

- Fastest Growing Broker – World Financial Award

- Best Customer Support – Forex Brokers Association

Support operates 24/5 via live chat, email, and multilingual portals. User reviews frequently highlight short response times and non-scripted answers.

In this case, the awards reflect real service quality — a point where the broker exceeds expectations.

Trader Reviews: What Users Really Say

Analysis of user feedback across forums, review platforms, and independent blogs shows clear trends:

- Positive: Low costs, fast execution, functional MT5, transparent terms

- Neutral: Offshore regulation

- Negative: Cent account spreads during high volatility, no phone support in some regions

Overall, Gracex earns trust for doing what it claims — especially on cost structure and execution transparency.

Final Verdict: What Turned Out True and What Was Just Marketing?

✅ Yes — Gracex stands out for its low-cost trading, transparent account options, and stable platform access.

❌ No — If you’re expecting Tier 1 regulation or deep market research tools.

⚖ It Depends — On your trading style. For algorithmic or high-frequency trading, Gracex is ideal.

In conclusion: Gracex delivers on most of its 2025 promises. It’s not revolutionary — but it’s refreshingly honest and efficient.

All Reviews About Gracex

- Gracexfx.com Reviews: Real Trader Opinions in 2025

- Gracexfx.com Reviews: Is This Broker Worth Trusting?

- Gracexfx.com Reviews – Honest Feedback and Insights

- Gracexfx Reviews: What You Need to Know Before Trading

- Gracexfx Reviews: Real Trader Experiences in 2025

- Gracexfx Reviews – Honest Insights from Investors

- Gracex Reviews: Real Opinions from Traders in 2025

- Gracex Reviews: Is This Broker Worth Your Trust?

- Gracex Reviews: Facts, Myths, and Honest Feedback

- Gracex Reviews 2025: Why This Platform Is Gaining Attention

- Gracex Reviews 2025: The Truth About This Broker

- Gracex Reviews 2025 – Real Experiences from Investors

- Gracex Reviews – Complete Guide for Beginners and Pros

- Gracex Reviews – What Investors Really Think